Explore why Bajaj Finance shares saw a 90% dip—analysis, stock split, bonus issue, and what it means for investors in this deep-dive guide.

1. Introduction: A Morning That Shook My Portfolio

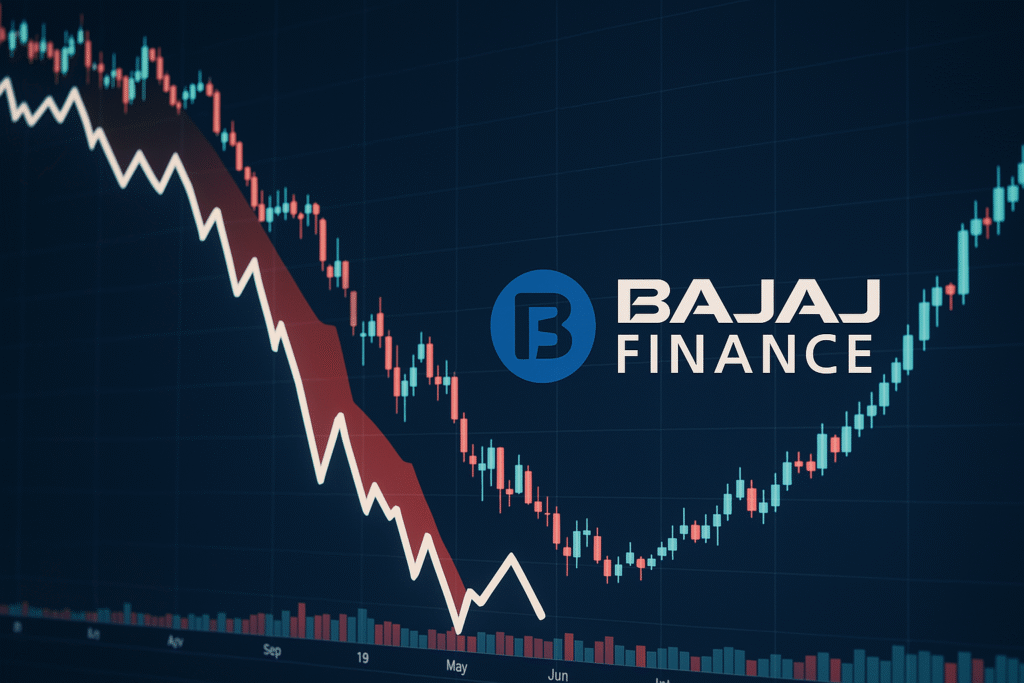

June 16, 2025 — a date I won’t forget anytime soon. It started like any regular Monday morning. I brewed my coffee, opened my laptop, and casually logged into my trading account, as I do every day. But what I saw next made my heart sink. My Bajaj Finance shares—usually the crown jewel of my portfolio—were showing a massive 90% drop. I blinked. I refreshed. Nothing changed.

Panic set in. Was there a scam? A flash crash? A massive regulatory issue?

In those first few minutes, I did what every retail investor probably did—I started searching frantically on Google, scrolling through X (formerly Twitter), and refreshing market news every 10 seconds. I even wondered if I should just sell whatever was left before it went to zero. The numbers didn’t make any sense. Bajaj Finance, a company that has built a reputation for rock-solid financials, strong growth, and investor-friendly policies, just couldn’t collapse like this overnight.

Then I saw it. Tucked into a news update was the real story: a combination of a stock split and a bonus issue had gone into effect. And just like that, the picture started becoming clear. My portfolio hadn’t actually lost 90%—it had just been restructured. The number of shares I held had multiplied, and the price per share had been adjusted accordingly. The value was more or less the same.

That moment was a turning point for me—not just emotionally but as a retail investor. I realized how little we’re sometimes prepared for technical events like splits and bonuses, and how crucial it is to understand these mechanisms, especially with market giants like Bajaj Finance.

So, I decided to write this detailed blog. Not just as an investor, but as someone who went through the confusion firsthand. If you’re reading this because you saw the same dip and panicked—relax. Let’s break down what really happened, why it’s not a disaster, and what this could mean for your investment journey ahead.

2. The Morning Shock: When a 90% Crash Doesn’t Mean a Loss

The shock of that Monday morning still gives me a chill when I think about it. Imagine waking up, logging into your demat account, and seeing one of your most trusted stocks—Bajaj Finance—down by almost 90%. I genuinely thought I was staring at the aftermath of some financial apocalypse.

At first, I blamed the app. I thought it was a glitch. I switched from Groww to Zerodha, then to Moneycontrol. Same numbers. My single share, which used to be worth around ₹9,300, was now showing up at just ₹934. I stared at the screen, confused and stressed, trying to figure out what I had missed.

The news headlines weren’t helping much either. Articles were flying around with titles like “Bajaj Finance Crashes 90%!” and “Investors Panic as Stock Tanks After Record Date!” It felt like everyone had hit the panic button at the same time. Social media was flooded with memes, angry comments, and worried retail investors like me asking, “Is this the end for Bajaj Finance?”

I was about two clicks away from selling my shares just to cut losses when I finally found an explanation tucked away in a small business update. It wasn’t a crash. It wasn’t a mistake. It was a planned corporate action—a 1:2 stock split combined with a 1:4 bonus issue.

At first, I didn’t completely understand what that meant. I had heard of splits and bonuses before, but never experienced one myself. And this—both happening at once? No wonder it looked like a free fall. My share count had increased, and the price per share had dropped in proportion, but the total value of my investment hadn’t changed. The numbers just looked scary until I connected the dots.

In hindsight, I wish I had known more before that morning. But if you went through the same heart attack-inducing moment, I want to assure you—it wasn’t just you. And more importantly, your investment in Bajaj Finance is likely just as solid as it was the day before. You’ve just become part of a well-thought-out strategy by one of India’s top NBFCs to make its stock more affordable and liquid.

Let’s now unpack exactly what happened, how it works, and why this “crash” might actually be good news in disguise.

3. Bonus Issue vs. Stock Split: The Core Differences (Explained Simply)

I’ll admit it—I used to think a bonus issue and a stock split were pretty much the same thing. Honestly, before the Bajaj Finance incident, I had never cared enough to dig deeper. But when I saw that jaw-dropping 90% price drop on June 16, I had no choice but to educate myself real quick. And once I understood the difference, I realized how important it is for every investor to know this—not just during a corporate action, but for long-term confidence in your holdings.

So, here’s how I’ve come to explain it to friends and family (and hopefully, you too).

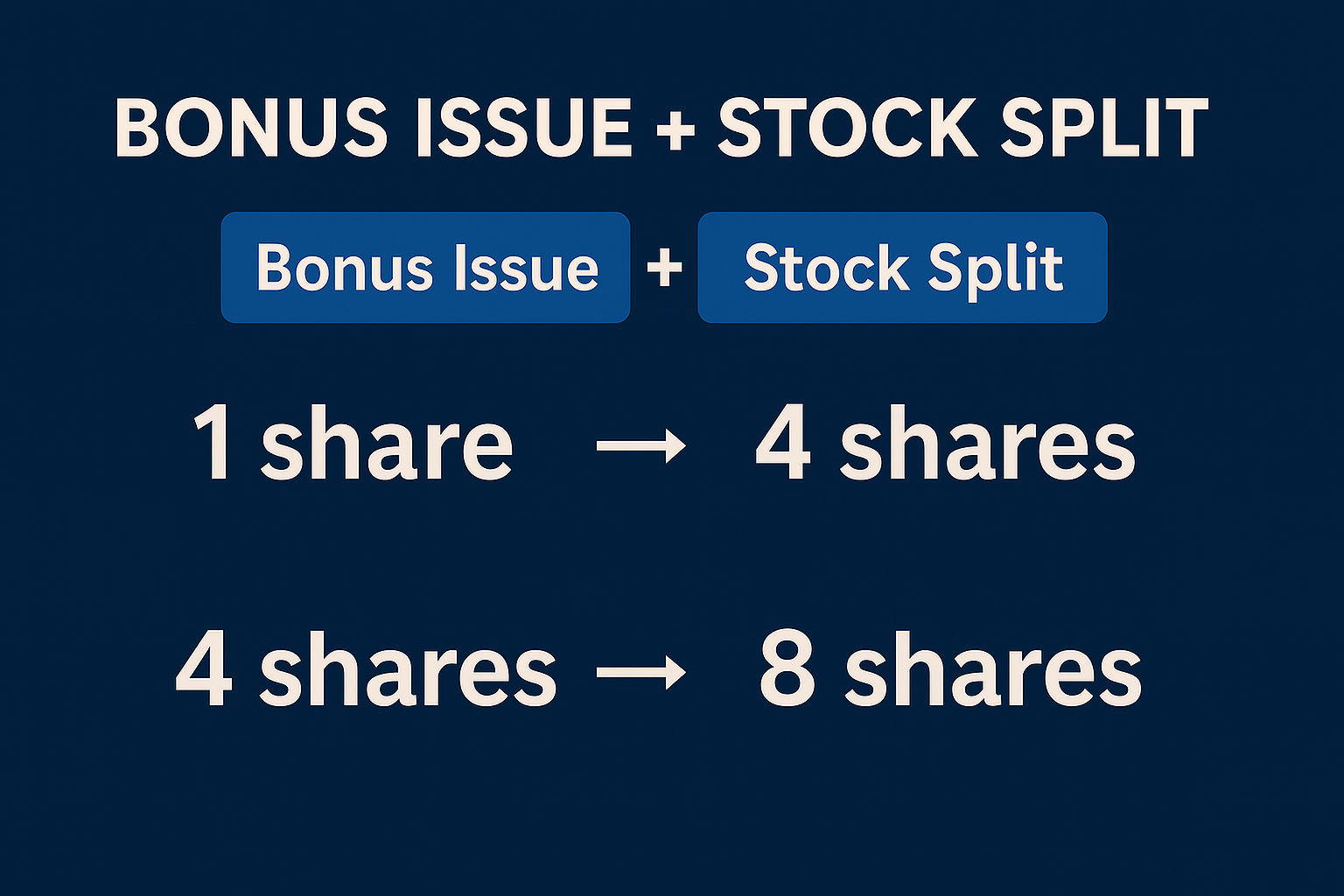

What is a Bonus Issue?

Think of a bonus issue as a “thank you” gift from the company to its existing shareholders. The company gives you free additional shares, based on how many you already own. In Bajaj Finance’s case, the ratio was 1:4—that means for every 1 share I held, I got 4 extra shares for free.

Let’s say I had 10 shares before the bonus:

- After the bonus issue, I would now have 10 (original) + 40 (bonus) = 50 shares.

- But, the value of the company hasn’t changed. So, the market adjusts the price per share accordingly.

- If my 1 share was worth ₹9,340 before the bonus, after the 1:4 bonus, the new share price would reduce to roughly ₹1,868 (₹9,340 ÷ 5).

At first glance, it feels like you’ve “lost” value because the price per share drops. But you haven’t—the number of shares increases in proportion. The total investment value remains the same.

What is a Stock Split?

Now, a stock split is a little different. Instead of giving you new shares, the company simply divides your existing shares into smaller parts, making each share more affordable.

In Bajaj Finance’s case, the split was 1:2, meaning each of my post-bonus shares was further split into 2.

So, taking the earlier example:

- I had 50 shares post-bonus.

- After the 1:2 split, I now had 100 shares.

- Again, the price is halved to maintain the same total value. So, ₹1,868 becomes roughly ₹934 per share.

Here’s a simple way I think of it:

| Action | What You Get | What It Means |

|---|---|---|

| Bonus Issue | Free shares | Company gives you more ownership |

| Stock Split | Smaller unit shares | Makes shares cheaper & more liquid |

So Why Do Companies Do This?

Initially, I thought: why complicate things? Why not just leave the share price alone?

But here’s the thing—both actions are usually done to improve liquidity and attract more retail investors. When shares are trading at ₹9,000+, they feel out of reach for small investors. By reducing the price and increasing the number of shares in circulation, companies like Bajaj Finance make it easier for people to buy in.

And in my case, once the dust settled and I had 100 shares at ₹934 each instead of 10 shares at ₹9,340, I realized nothing had really changed—except my understanding.

Bottom Line (What I Learned the Hard Way)

A bonus issue and a stock split aren’t reasons to panic—they’re just corporate tools to restructure how a company’s ownership is distributed. Your piece of the pie doesn’t shrink; the slices just get smaller, and you get more of them.

So, if you ever wake up to what looks like a 90% crash again, don’t sell in fear like I almost did. Take a deep breath, read the company’s announcements, and understand the math. It’ll save you stress—and potentially a costly mistake.

Next, let’s look at a real example (mine!) of how these changes actually played out in numbers.

4. Real-World Example: What Actually Happened to My Bajaj Finance Shares

Alright, let me walk you through my actual numbers—because seeing the math in action really helped me understand what had happened. And if you’re anything like me, a real-world example makes way more sense than technical jargon.

So here’s how it went for me:

Before June 16, 2025, I held 1 share of Bajaj Finance, which I had purchased for around ₹9,340. It was one of those “blue-chip” stocks I had bought as a long-term play—solid fundamentals, good earnings, decent dividend payout. Everything looked great.

Then came the corporate actions.

Step 1: The Bonus Issue

Bajaj Finance declared a 1:4 bonus issue. That means for every 1 share I owned, I received 4 additional shares for free.

- My 1 share became 5 shares (1 original + 4 bonus).

- But now, the total value of those 5 shares still needed to equal the original ₹9,340.

- So the market adjusted the price per share to: ₹9,340 ÷ 5 = ₹1,868 per share.

At this point, I still had the same total investment value, just more shares at a lower price.

Step 2: The Stock Split

Right after the bonus shares were credited (or rather, on the record date), Bajaj Finance also executed a 1:2 stock split. This meant that each of my 5 shares was now split into 2 shares.

- 5 shares became 10 shares.

- And the price per share was again halved: ₹1,868 ÷ 2 = ₹934 per share.

So now, post both actions, I had:

- 10 shares

- Priced at approximately ₹934 each

- Total value: 10 × ₹934 = ₹9,340

Same value. Different structure.

And yet, when I first saw the ₹934 price tag, I thought I had lost everything.

Seeing It on My Portfolio App

Most trading apps showed the adjusted price, but the increased quantity of shares wasn’t always updated immediately. So for a brief period, my app was showing just ₹934 as the market value—without reflecting the fact that I now had 10 shares.

No wonder I panicked.

It wasn’t until later in the day, when both the stock exchanges and my broker updated the number of shares in my demat account, that everything looked “normal” again. In fact, my portfolio value was completely intact.

The Emotional Rollercoaster

That day was a learning curve. I started the morning thinking I had lost 90% of my investment. By afternoon, I realized I hadn’t lost a single rupee. If anything, I had gained a new appreciation for how stock market mechanics work.

It also made me more confident about holding onto Bajaj Finance. Any company that takes the time to do thoughtful corporate restructuring—without diluting shareholder value—is probably thinking about long-term growth and broader investor participation.

What I Tell My Friends Now

Now whenever someone brings up “stock splits” or “bonus shares,” I jump in with my story. It’s not just textbook knowledge anymore—it’s something I lived through. And if you’re holding Bajaj Finance shares right now, or are considering investing after this price adjustment, just know:

Your value is still intact.

You didn’t lose money.

You just own a bigger piece of smaller slices.

Next up, let’s take a look at the official timeline of these events, so you know exactly what happened—and when.

5. Timeline of Events & Crediting: How It All Unfolded

After finally calming down from the initial shock, I decided to dig deeper. I wanted to know exactly what happened and when, so I wouldn’t be caught off guard again. And I’ve got to say, once I saw the full timeline, everything started to make a lot more sense.

Let me walk you through how things played out, step-by-step, from an investor’s perspective.

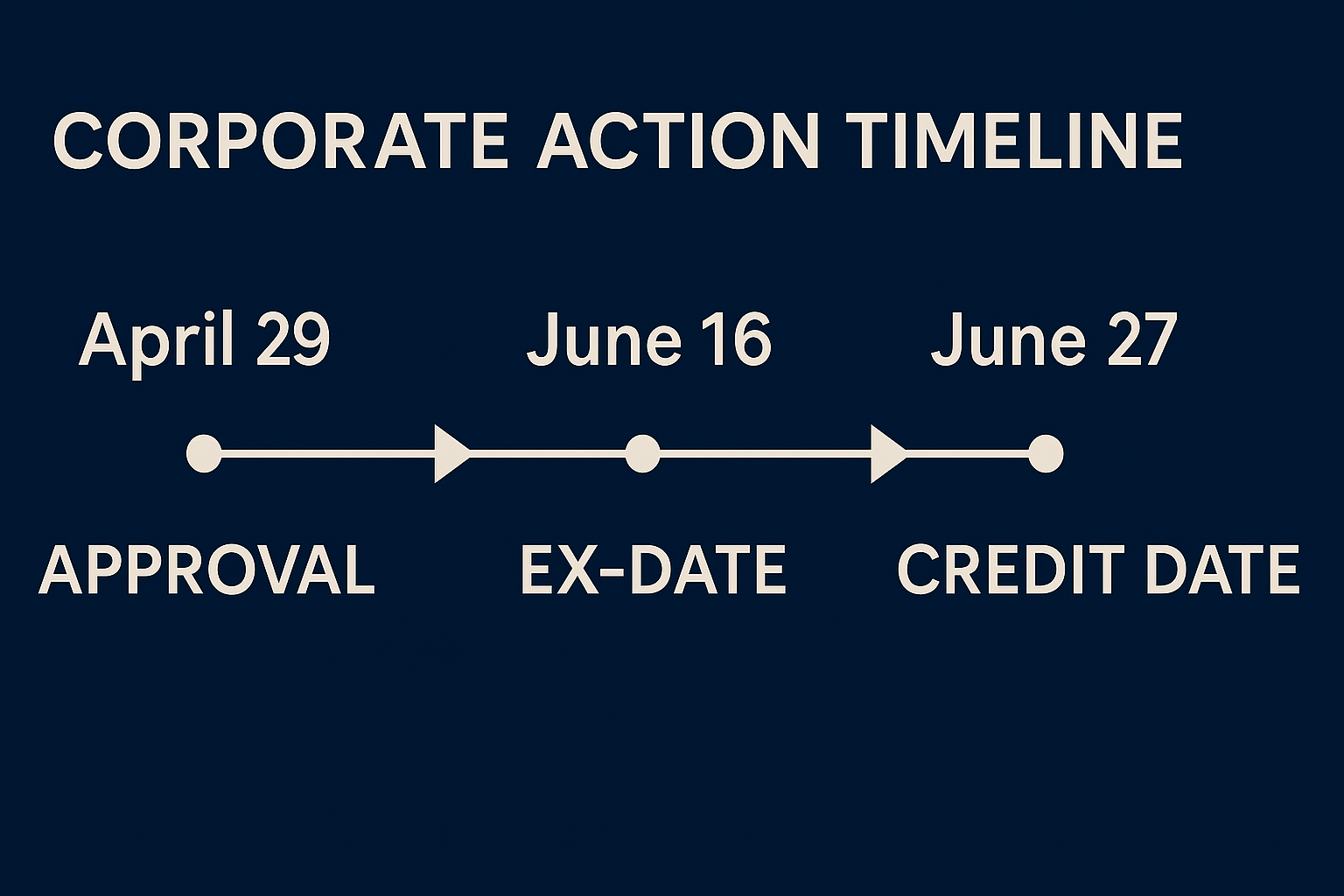

April 29, 2025 – The Announcement

This is when it all began. During Bajaj Finance’s board meeting on April 29, the company announced two major corporate actions:

- A 1:4 bonus issue

- A 1:2 stock split

At the time, I saw the headline but didn’t really give it much thought. I just assumed, “Oh great, some bonus shares are coming. Cool.” But in hindsight, I should’ve taken it more seriously and read the fine print.

June 14, 2025 – The Last Day to Buy Shares (T+1 Settlement)

This date kind of flew under the radar for me—and for a lot of investors, I think.

If you wanted to be eligible for the bonus and stock split, you had to own shares by June 14. Since India follows a T+1 settlement system, buying on the 14th meant your shares would be credited and “settled” by June 15, making you eligible for the June 16 record date.

Thankfully, I already held shares, so I didn’t have to worry. But a few friends who bought on the 15th missed out. That stung.

June 16, 2025 – The Record Date & The Dip

This was the big day—the “heart attack morning,” as I now call it.

On this day, Bajaj Finance went ex-bonus and ex-split, meaning that the adjusted share price came into effect, and the eligibility was finalized. The moment markets opened, the stock was already reflecting the split and bonus adjustments.

That’s why the price dropped from around ₹9,300 to ₹934. But remember—this was not a loss, just a mathematical adjustment.

Still, most trading apps didn’t update the share count immediately, so all we saw was a massive price drop and no extra shares to make up for it. That caused widespread confusion and panic selling—totally understandable, given how unclear it all looked.

June 18–27, 2025 – Shares Get Credited

Here’s the part I really had to wait for: the actual crediting of bonus and split shares into my demat account.

While the record date was June 16, the shares didn’t appear in my account instantly. It took a few days. I kept refreshing my app like a maniac until, finally, by June 27, everything was in place:

- My 1 original share had turned into 10 shares

- The price had adjusted to around ₹934

- My total investment value remained almost exactly the same

A Personal Note on Patience

If there’s one lesson I took away from this whole process, it’s this: patience is key in the stock market—especially when corporate actions are involved. The systems work, but they take time. The waiting can be stressful, especially when your screen is showing weird numbers and you feel like something’s gone horribly wrong.

But once I understood the timeline and saw the shares reflected correctly in my account, I actually felt good about it. Bajaj Finance didn’t just make its stock more affordable—it also proved that it was investor-focused, transparent, and forward-thinking.

Quick Recap of the Key Dates

| Date | Event |

|---|---|

| April 29, 2025 | Bonus & split announcement by Bajaj Finance board |

| June 14, 2025 | Last day to buy shares (T+1 settlement) |

| June 16, 2025 | Record date – stock trades ex-split & ex-bonus |

| June 18–27, 2025 | New shares credited to demat accounts |

Looking back, it was a rollercoaster week, but also a great learning experience. If you’re holding Bajaj Finance shares or planning to enter now that prices seem more “affordable,” understanding this timeline will help you make smarter decisions—and stay calm the next time a big corporate event rolls around.

Up next, let’s explore how the market reacted right after these changes, and what the price action told us.

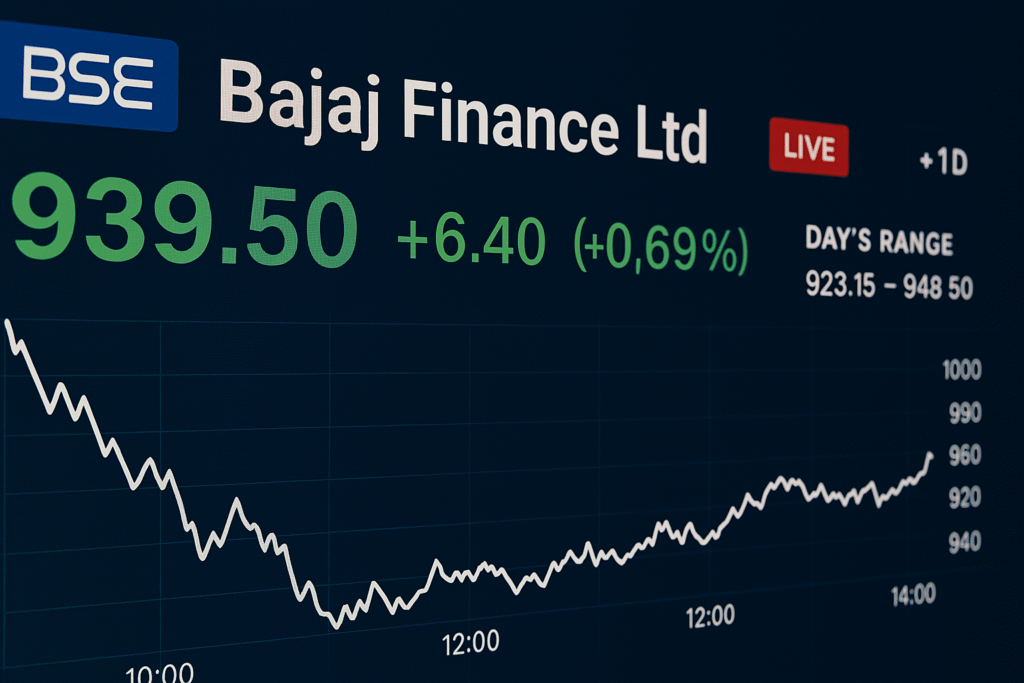

6. Market Reaction & Price Behavior: What I Saw (and Felt) in Real-Time

Once the chaos of June 16 hit and the reality of the stock split and bonus issue settled in, I kept refreshing my stock tracking app like I was watching a cricket score in the last over. Honestly, I was glued to my screen, trying to make sense of the market’s reaction to Bajaj Finance’s adjusted price.

And what I saw over the next few days was… well, fascinating.

Day 1 – The Confusion Era

Let’s talk about June 16, the record date. The day Bajaj Finance went ex-bonus and ex-split.

The share opened around ₹934, as expected after all the corporate adjustments. But clearly, not everyone got the memo. There was a ton of confusion across the board. Retail investors flooded social media with posts like:

- “Why is Bajaj Finance crashing?”

- “Did I lose 90% of my money?”

- “Is this a scam or technical glitch?”

Frankly, I don’t blame them. The pricing didn’t reflect the increased quantity of shares immediately on most platforms. In my case, Groww showed ₹934 per share—but still only 1 share in quantity, which made it seem like I had lost more than ₹8,000. Only by checking the official announcement from Bajaj Finance (and doing some fast math) did I calm down.

But what really caught my eye was how the volume spiked massively that day. Everyone—from small traders to institutions—seemed to be reacting. Some sold in panic. Others saw a “cheaper” Bajaj Finance and started buying like it was a Diwali sale.

Days 2–4 – Calm After the Storm

By around June 18, things started to normalize. Demat accounts slowly began to reflect the correct number of shares, and the noise around the “crash” began to die down.

But here’s the interesting part: the stock didn’t collapse further. In fact, it held strong around the ₹930–₹950 range. That told me one big thing:

The fundamentals were still intact.

Smart money knew that this wasn’t a real loss—it was just a pricing adjustment. Once the corporate action was digested, the price stabilized. And that, to me, was a huge vote of confidence in Bajaj Finance’s strength.

Investor Sentiment: Fear → Relief → Opportunity

I noticed three clear emotional phases among investors (including myself):

- Fear (June 16) – Total confusion, panic, sell-offs, rumors flying.

- Relief (June 17–18) – People realized it was a split and bonus. No one actually lost money.

- Opportunity (Post June 19) – Suddenly, Bajaj Finance shares felt “affordable,” and more retail buyers started piling in.

I personally know at least three friends who had always wanted to invest in Bajaj Finance but felt it was “too expensive.” After the split, they finally took the plunge.

Technical Indicators (for Those Who Watch Charts)

Even though I’m more of a long-term investor, I do dabble in chart analysis. Here’s what I saw post-split:

- Support formed quickly around the ₹920–₹930 range.

- RSI (Relative Strength Index) showed neutral territory—no signs of overbuying or panic selling.

- A modest uptrend started forming after a couple of days, showing renewed interest.

This tells me that Bajaj Finance’s split and bonus action was seen positively by the market over time.

What the Experts Were Saying

Some articles and experts even said this move could unlock more liquidity and bring in fresh investors—which I now completely understand. At a ₹9,000+ price tag, many retail folks hesitate. At ₹930? Suddenly, it’s a lot more accessible.

Here’s a great piece from The Economic Times explaining the company’s corporate action

My Takeaway as a Retail Investor

This wasn’t just a technical adjustment. It was a real-world lesson in market psychology, investor behavior, and the importance of understanding what you’re holding. I’ve always heard “don’t panic sell,” but this time, I truly lived it.

Now, every time I look at my Bajaj Finance shares—10 of them sitting quietly at ₹934 each—I don’t see a crash. I see a story. A reminder that the market may react emotionally in the short term, but logic, math, and solid fundamentals always win in the end.

Next, let’s zoom out a bit and look at what this move could mean in the long term—for Bajaj Finance as a company and for us investors.

7. Why Bajaj Finance Did This (Sharing My Thoughts as an Investor)

After the initial confusion settled and I took a few deep breaths, I sat down with a cup of coffee and started thinking:

Why did Bajaj Finance do this bonus issue and stock split?

At first glance, it felt unnecessary — the company was doing well, the stock price was strong, and everything seemed stable. But the more I thought about it, the more it made sense. And now, having experienced it firsthand, I can honestly say this wasn’t just a random move — it was a smart, calculated decision.

Let me walk you through what I realized, from one investor to another.

1. To Make the Stock Look More Affordable

One of the first things that clicked in my mind was how intimidating Bajaj Finance’s share price was before all this.

I remember when I first bought the stock — it was trading at around ₹9,000. Honestly, that made me hesitate. I was thinking, “Am I really going to spend this much on just one share?”

Now, after the stock split and bonus issue, the price came down to around ₹930. Same company, same fundamentals — but suddenly it felt a lot more approachable. And that’s powerful.

I’ve already had friends who previously stayed away from high-priced stocks message me saying, “Hey, Bajaj Finance is under ₹1,000 now. Is this a good time to get in?” And I get it — psychologically, it feels better to own 10 shares at ₹930 than 1 share at ₹9,300, even if the total investment is the same.

So yeah, I believe this move made the stock more accessible to small retail investors like me.

2. To Increase Liquidity in the Market

Before this corporate action, Bajaj Finance had relatively lower trading volumes compared to other mid-priced stocks. A high share price naturally keeps casual traders away.

Now, with the stock split and bonus issue, the number of outstanding shares has increased dramatically. That means more shares to buy and sell in the market, and that means more liquidity.

And trust me, liquidity matters. It makes it easier to enter and exit a stock without big price gaps, which is especially important when markets are volatile. Since the split, I’ve noticed the bid-ask spreads have tightened, and volumes have picked up — it’s just easier to trade now.

3. To Reward Loyal Investors (Like Us!)

This part really stood out to me.

Let’s be honest, holding onto a stock for the long term isn’t always easy — especially during market dips or when the news is full of negativity. But Bajaj Finance has always felt like a long-term bet to me, and this move proved I wasn’t wrong.

By issuing bonus shares and splitting the stock, they basically told us, “Thanks for staying invested.” No cash outflow for them, but for us, it was a tangible benefit.

It reminded me of a small dividend or a loyalty bonus — not in rupees, but in trust. And that kind of relationship with a company makes me want to stay invested even longer.

4. To Prepare for Future Growth

This might be more speculative on my part, but I’ve been following Bajaj Finance for a few years, and I know they’re aiming big — expansion in digital lending, increasing their customer base, scaling up partnerships, etc.

I genuinely think this corporate restructuring is part of a long-term growth plan.

- Make the stock more affordable → more retail participation

- More participation → more buzz, more visibility

- More visibility → potentially higher valuations and easier fundraising if needed

It’s like they’re setting the stage for the next chapter, and I appreciate that kind of forward thinking. This wasn’t just a technical move — it was strategic.

5. To Build Long-Term Trust in the Brand

This might sound sentimental, but for me, investing isn’t just about numbers — it’s about trust. And this entire experience, from the way Bajaj Finance communicated the change to how smoothly things got credited (even if there was some delay), felt transparent and well-executed.

It didn’t feel like a gimmick or a cover-up. They weren’t trying to hide anything. In fact, they were very upfront, and the move was well-documented in public filings.

And to be honest, that earned even more of my trust. I’d rather invest in a company that values its shareholders and communicates clearly, than one that treats us like afterthoughts.

Final Thoughts

When I first saw the price drop from ₹9,300 to ₹930, my heart sank. I really thought something terrible had happened. But after going through this journey, I’ve come to realize:

- The company didn’t lose value.

- I didn’t lose money.

- In fact, I gained more shares and more confidence in the company.

Now, every time I open my portfolio and see 10 shares instead of 1, I smile. Not because the number went up — but because I understand it now.

This wasn’t just a stock move — it was a lesson. One that made me a better investor, and even more bullish on Bajaj Finance for the long run.

8. Fundamentals: Why It Matters (And How It Helped Me Stay Calm)

Let me be honest with you — when I first saw the Bajaj Finance share price crash by 90% overnight (from ₹9,300 to ₹930), I felt like the ground slipped under my feet. My heart sank. I actually refreshed my portfolio app three times just to make sure it wasn’t a glitch.

But after going through the rollercoaster of emotions, I paused and asked myself one simple question:

“Did anything actually change about the company?”

That question led me down a path that not only helped me stay calm but also taught me one of the most important investing lessons of my life:

Always come back to the fundamentals.

The Stock Price Dropped — But the Business Didn’t

Once I read the official announcement and understood it was a stock split and bonus issue — not a crash due to bad performance — I checked Bajaj Finance’s recent earnings reports and updates.

Guess what?

- Net profit was still growing.

- Loan book was healthy.

- NPA (non-performing assets) levels were under control.

- Their customer base was expanding quarter after quarter.

- Their digital transformation journey was on track.

In short, the company was performing just as strongly as it was the day before. The only thing that changed was how many shares I owned and the price per share. The fundamentals — the actual strength of the business — stayed rock solid.

My Personal Checklist (What I Look At Now)

After this experience, I built a mental checklist I use whenever I feel uncertain about a stock I own. It’s simple, but it gives me peace of mind:

- Revenue growth – Are sales increasing steadily?

- Profit margins – Is the business becoming more efficient?

- Debt levels – Are they managing loans wisely?

- Return on equity (ROE) – Are they using investor capital effectively?

- Future outlook – Is there a clear growth plan?

I ran Bajaj Finance through this checklist and realized — wow, this company isn’t just “doing fine”… it’s thriving.

The News vs. The Numbers

During the week of the price adjustment, a lot of news headlines screamed:

“Bajaj Finance Crashes 90%!” or “Massive Fall Shocks Investors!”

That stuff gets clicks, but it doesn’t tell the full story.

Because when you look at the actual numbers, the company’s fundamentals were completely intact. I saw this with my own eyes, and it reminded me not to let short-term noise distract me from long-term facts.

I even revisited their quarterly report and investor presentations (they’re available publicly on BSE India and NSE) — and that gave me so much confidence.

What I Learned the Hard Way

Before this happened, I used to react emotionally to price movements. If something dropped 10% or 20%, I’d panic-sell. But this Bajaj Finance experience changed how I think.

Because when I stayed focused on the company’s fundamentals — not the share price — I realized:

- I wasn’t losing anything.

- My ownership in the business remained exactly the same.

- The company was still performing just as well.

- And over time, the market would recognize that again.

That realization made me stronger as an investor.

Why Fundamentals Will Always Matter (No Matter What the Price Says)

Here’s the truth no one tells you on day one: stock prices move every day, but the real value of a business changes slowly — over months and years.

Bajaj Finance isn’t just a ticker symbol. It’s a real company with thousands of employees, millions of customers, and a proven track record of growth.

That’s why I stayed invested. Not because the price was low, but because the business underneath the stock was still solid.

And I believe — just like in life — if the foundation is strong, temporary shocks can’t shake you for long.

My Advice (If You’re Still Nervous)

If you’ve been feeling confused or nervous about the Bajaj Finance share price situation, here’s my two cents:

- Don’t judge a company by its price alone.

- Learn how to read the basics — revenue, profit, and debt.

- Follow how the business is actually performing, not what the headlines say.

- And most importantly — stay calm when others panic.

Because in the end, investing is about owning great businesses — not just betting on stock prices.

Bajaj Finance reminded me of that the hard way. But now that I’ve seen how strong fundamentals can carry you through panic, I feel much more confident in every investment I make.

9. Expert Opinions & Analyst Outlook (And What I Took Away from Them)

After the initial buzz of the Bajaj Finance stock split and bonus issue settled, I did what any curious investor would do — I turned to the experts.

I wanted to know:

“Was I overthinking this, or was there something deeper going on that I should pay attention to?”

So, I started reading through brokerage reports, watching expert interviews on CNBC and YouTube, and following updates on platforms like Moneycontrol and Economic Times. What I found gave me even more confidence in my investment — and I’ll share the highlights with you.

What Analysts Are Saying

Almost every major research house had something to say about the post-split Bajaj Finance. The interesting part? Most of them remained quite bullish on the company despite the price adjustment.

Motilal Oswal, for instance, maintained a “Buy” rating with a long-term target price that, after adjusting for the split and bonus, still reflected a potential upside of 20–25%. They emphasized the company’s strong asset quality and robust digital transformation plans.

ICICI Direct released a note mentioning that the corporate action would “enhance liquidity and participation,” which is expected to bring more retail investors into the fold — a positive sign for long-term market depth.

Then there was Kotak Institutional Equities, which highlighted that Bajaj Finance’s financials remain healthy. They pointed out that the company has an excellent return on equity (ROE) track record and is well-capitalized to pursue future growth.

What I learned from all this? The experts weren’t rattled by the price adjustment — because they understood it was cosmetic. They were still focused on earnings, profitability, and the company’s ability to execute.

What the Media Is Reporting

Some of the headlines were quite dramatic — “Bajaj Finance crashes 90%!” — but the fine print told a very different story.

An article from News18 did a great job of explaining that this wasn’t a loss in value, but a simple adjustment. It also mentioned that this move was a strategic decision to boost affordability and increase market liquidity.

Another helpful source was the Economic Times Bajaj Finance page, which tracks every small update about the company — from investor calls to quarterly earnings. After reading a few detailed updates there, I got a better sense of how the company is handling growth and risk.

Honestly, reading the news after understanding the fundamentals and corporate action made me realize how easy it is to get swept up in noise if you don’t pause and dig deeper.

My Takeaway from the Experts

Here’s what clicked for me after going through all this research:

- Experts aren’t worried — so maybe I shouldn’t be either.

- The business remains fundamentally strong, and future projections still look promising.

- The stock price change is more about perception than performance.

- Many analysts still believe Bajaj Finance is one of the strongest NBFCs in India, with massive digital potential.

In fact, some experts even believe the split and bonus could improve the company’s long-term valuation because it increases participation and liquidity.

One Thing I Noticed That No One Talks About

Something I picked up after watching and reading a lot of expert takes was this:

Almost all of them agreed the corporate action was not just about stock price — it was about positioning the company for a new phase of growth.

Think about it: they’re moving toward digital-first services, expanding customer segments, and adapting fast to new technologies. This stock restructuring aligns with that modern, more inclusive approach.

As an investor, that tells me the company is not just looking good on paper — it’s thinking ahead.

What I’m Doing Next (After Reading the Expert Takes)

After all this research, here’s what I’ve decided to do:

- I’m holding my Bajaj Finance shares.

- I’m keeping an eye on their upcoming earnings and digital initiatives.

- And yes — I’ve set a price alert in case it dips again, so I can add more at the right moment.

Experts may not always be right, but when a company’s fundamentals align with strong institutional support and thoughtful corporate action — that’s usually a green flag for me.

If you’re reading this and still feeling unsure, I’d say: look beyond the headlines. Read what the analysts are writing, listen to those quarterly calls if you can, and most importantly — trust your own research.

Because once you understand why something happened, you no longer fear it. And that’s exactly what happened with me and Bajaj Finance.

10. What Investors Should Do Now (Here’s What I’m Personally Doing)

If you’re holding Bajaj Finance shares right now — or thinking about buying them — you’re probably wondering: “What should I do next?”

Trust me, I’ve asked myself the same question more than once since the split and bonus issue. At first, I was confused. Then, after digging deeper, I found clarity. Now, I feel more confident than ever about my decision — and I want to share what I’ve learned with you, not as a financial advisor, but as a fellow investor who went through this rollercoaster firsthand.

Step 1: Don’t Panic — Understand the Math

The most important thing I can tell you is this:

You haven’t lost anything.

When the share price dropped from around ₹9,300 to ₹930, it wasn’t because the company was in trouble. It was purely a technical adjustment due to the 1:1 bonus issue and 1:5 stock split.

So if you had:

- 1 share at ₹9,300 → You now have 10 shares at ₹930.

The total value of your holding is still the same (more or less, depending on minor market fluctuations). It’s like exchanging a ₹2,000 note for ten ₹200 notes — the value doesn’t change, just the units.

Once I truly understood that, I stopped worrying about the “crash.”

Step 2: Re-Evaluate the Business, Not the Price

After things settled down, I revisited Bajaj Finance’s fundamentals. I looked at:

- Their latest quarterly results

- Loan book performance

- Asset quality

- Growth strategy, especially their push into digital lending

Everything looked solid — even exciting, honestly.

I realized that the price was irrelevant if the business remained strong. This was a massive mindset shift for me. It turned my focus from short-term noise to long-term value.

If you’re unsure right now, I’d say do this:

Ignore the price chart for a moment and read their earnings report or investor presentation (they’re available on their official site or on NSE India).

Step 3: Decide Your Strategy Based on Your Goals

Let me walk you through what I’m personally doing — and you can see if it aligns with your situation.

- If you’re already invested:

I’m holding my Bajaj Finance shares. I believe in the company’s long-term potential, and now that the price is more accessible, I might even add more if there’s a dip. - If you’re thinking of buying:

This could be a great opportunity. The lower price point makes it easier to start small. I’d suggest using a SIP (Systematic Investment Plan) approach if you’re nervous. That’s what a few of my friends have started doing — ₹1,000 or ₹2,000 every month — and it feels a lot less risky than going all in. - If you’re short-term focused:

You might see some volatility in the next few weeks as the market adjusts to the new price. But if you’re trading, just remember to use stop-losses and stay updated on news and earnings. Personally, I’m not trading this stock — I’m holding it as a long-term investment.

Step 4: Tune Out the Noise

One of the biggest mistakes I made in my early investing days was reacting to every little headline. When I saw “Bajaj Finance falls 90%,” I almost sold my holdings in a panic.

But now, I’ve learned to pause, research, and reflect before reacting.

The market loves drama. But real investing is about patience.

If you’ve done your research and believe in the company, don’t let short-term news shake your confidence.

Step 5: Keep Learning (This Event Taught Me A Lot)

This entire episode — the split, the bonus, the price confusion — became a huge learning opportunity for me. I now understand corporate actions better, and I’ve realized how important it is to stay calm during chaos.

I even started following financial YouTubers like CA Rachana Phadke and Vivek Bajaj to deepen my understanding — and trust me, once you understand why something happens, you’ll never panic the same way again.

Final Thoughts (From One Investor to Another)

Here’s my honest takeaway:

Bajaj Finance didn’t do this to trick investors. They did it to make their shares more accessible and their business more appealing to a wider range of people — especially retail investors like us.

So, what should you do now?

- Don’t sell out of fear.

- Revisit the fundamentals.

- Decide your investment horizon.

- Use this moment to learn and grow as an investor.

I’m not just holding my shares — I’m more confident in them than ever. And if the fundamentals stay this strong, I’ll be adding more in the future.

Whatever you choose, just make sure it’s based on your own research and your own conviction — not panic.

Happy investing. Keep learning. Stay strong.

11. Risks & Considerations (From Someone Who’s Learned the Hard Way)

Let me be straight with you — no matter how solid a company looks on paper, every investment comes with risk. And I say this not as a disclaimer, but as someone who has seen both green and red in their portfolio.

Bajaj Finance is one of my core holdings, and while I have faith in the company, I’ve also trained myself to keep an eye on potential risks. If there’s one thing the markets have taught me, it’s this: hope is not a strategy — awareness is.

So here are a few honest risks and considerations I personally keep in mind when holding (or adding to) Bajaj Finance shares.

1. Rising Interest Rates

As an NBFC (Non-Banking Financial Company), Bajaj Finance relies on borrowing money at a certain rate and lending it out at a higher one. But when interest rates start going up (like we’ve seen recently), their cost of borrowing increases.

This could:

- Narrow their profit margins

- Make loan offerings less attractive

- Slow down growth in new customer acquisition

It hasn’t hit them hard yet, but it’s something I’m watching. I regularly check RBI announcements and try to gauge how rate hikes might ripple through Bajaj Finance’s balance sheet.

2. Competition in the Digital Lending Space

One thing I really admire about Bajaj Finance is how aggressively they’re going digital. Their app is slick, and their reach is phenomenal. But here’s the flip side: they’re not the only player in the game anymore.

New-age fintech startups, backed by heavy funding, are entering the same space. Banks are also upping their digital lending game. The moat that Bajaj Finance built years ago is now being challenged more than ever.

I’ve started tracking companies like Paytm, Cred, and even smaller players like Kissht — just to understand how the landscape is evolving. It’s not about panic, but staying prepared.

3. Regulatory Risks

One of the scariest things about investing in financial services is how quickly regulations can change.

For instance:

- Tighter rules on personal loans

- RBI restrictions on lending practices

- Changes in capital adequacy norms

- Sudden policy changes (like moratoriums)

These can affect margins, lending speed, and customer acquisition overnight. Bajaj Finance is known to be compliant and responsible, but regulatory overhang is always a risk in this sector.

Personally, I’ve started reading more updates from RBI and following reliable financial news sources like LiveMint and Moneycontrol to stay ahead.

4. Asset Quality Deterioration

If borrowers start defaulting on loans in large numbers, things can go south quickly. Bajaj Finance has kept its NPAs low for years, even during COVID, but macroeconomic conditions are always shifting.

Rising inflation, job losses, or economic slowdown could lead to:

- Higher defaults

- Pressure on recovery teams

- Impact on profitability

This is one area where I track quarterly NPA updates religiously. Even a 0.5% rise in Gross NPA can be an early warning signal.

5. Valuation Risk

This one’s big: Bajaj Finance has historically traded at premium valuations — and still does, even post the split and bonus. That means you’re paying more per rupee of earnings compared to other stocks.

And while I believe quality deserves a premium, the high P/E ratio also means the stock is vulnerable to corrections if the company ever misses its growth targets.

I personally avoid going “all in” during such phases. Instead, I average in slowly (especially after dips) rather than chasing a rally blindly.

A Personal Lesson: Ignoring Risk Cost Me Once

Back in 2020, I ignored a few red flags with a different NBFC — Dewan Housing. I thought, “They’re too big to fail.” Well, we all know how that ended. I lost 80% of my investment because I didn’t look at asset quality, debt levels, or market signals.

That experience taught me this:

Even great companies need to be monitored.

So with Bajaj Finance, I’m not just a fan — I’m a cautious one.

How I Manage These Risks Today

Here’s my personal approach:

- Diversification: Bajaj Finance is a top holding for me, but not the only one. I also hold ICICI Bank, HDFC AMC, and a few ETFs to balance my risk.

- Continuous Monitoring: Every quarter, I check their financial statements. I don’t just skim — I try to understand the story behind the numbers.

- SIP Strategy: Instead of lump sum investing, I use SIPs. It reduces timing risk and keeps me emotionally steady.

- Exit Plan: I don’t panic-sell, but I do have an internal rule — if Bajaj Finance sees consistent deterioration in NPAs or fails to grow revenue for multiple quarters, I’ll consider reducing exposure.

Final Thought: Risk Is Part of the Ride

Every great stock has its ups and downs. Bajaj Finance has had incredible highs — and some nervous moments too. But as long as you go in with your eyes wide open, know the risks, and have a clear plan, you’ll likely be in a much better position than someone just following the hype.

It’s okay to be excited — just don’t forget to be cautious too. That’s what I’ve learned. And honestly, it’s helped me stay invested with confidence instead of fear.

12. Conclusion & Personal Reflection (From One Investor to Another)

As I sit down to wrap up this blog, I can’t help but smile a little.

Not because Bajaj Finance is a perfect stock or because it always goes up — but because this entire experience, from the stock split to the bonus issue to the media noise, reminded me why I started investing in the first place:

To grow, to learn, and to build wealth with patience and purpose.

When the Bajaj Finance share price “crashed” by 90%, I’ll be honest — I panicked. I opened my app and thought something had gone terribly wrong. It took a few deep breaths, some reading, and a lot of self-talk to understand that it was simply a technical adjustment. But that moment? It taught me more than any book or course ever could.

It taught me:

- To pause before reacting

- To seek understanding, not assumptions

- And most importantly, to trust my long-term vision

Bajaj Finance has been a star performer in the Indian market for a reason. Their fundamentals are strong, their management is forward-thinking, and their approach to digital transformation is impressive. Do risks exist? Of course. But that’s true for any company — even the biggest names in the world.

What makes the difference is how you respond.

I’ve decided to hold on to my Bajaj Finance shares. Not because of loyalty, but because I believe in the numbers, the leadership, and the long-term potential. The lower price per share just means it’s easier for me to accumulate more — slowly, thoughtfully, and without pressure.

If you’re still reading this, I want to say thank you. I know this was long, but I wanted to share this not just as an analysis — but as an investor, a learner, and someone who has made mistakes, faced fear, and still chooses to stay in the game.

Whether you decide to invest in Bajaj Finance or not, my only advice is this:

Know what you’re buying. Understand why you’re holding. And never stop learning.

That mindset alone will make you a better investor than most people chasing the next big thing.

So here’s to smarter investing, clearer thinking, and holding on — not just to stocks, but to our convictions.

Thanks for reading. Wishing you peace of mind and profits ahead.

— A fellow investor on the journey with you. 💼📈

Image Prompt:

A reflective image of a person sitting at a desk with a laptop open to stock charts, a cup of coffee beside them, and a soft smile on their face — symbolizing calm and learning after chaos.

Let me know if you’d like this whole blog compiled into one final formatted document or want a downloadable version.